Main page of BERLiNiB:

BERLiNiB Employee Info

This page,

berlinib.com/

berlinib_employee_info

has in it company information

and information as to

how BERLiNiB gives

freelance salary

to individuals

in other countries

than the country

of origin of BERLiNiB,

namely Norway

(speaking in formal terms).

The first part is

chiefly information

to tax officials

in these other

countries.

The second part is

information to

new freelance

employees as to

what information

is required from

them to be correctly

registered as

freelancers for BERLiNiB

with the

Norwegian State's online

tax forms:

in sum, it is birth date

and either passport

number or the code

on a government-issued

id card.

As soon as you

have given BERLiNiB

this information

(which we treat

confidentially,

of course), find out

about how you pay tax

nationally on 'salary

received from a small

foreign company for

freelance work', and

do this paperwork

in same season.

INFORMATION FOR

TAX OFFICIALS

IN COUNTRIES

WITH FREELANCERS

WORKING FOR BERLiNiB

Those who contribute

to the BERLiNiB

magazine in a way

that involve us paying

them a salary

are registered as

employees, initially

of a freelance type,

so that they

can legally receive

salary for the work

they do through

such as Wise or PayPal

to their bank account.

See full formal info

about this company

at the bottom of

this page.

In general BERLiNiB,

which only comes

three times pr year and

with a certain number

of pages, does not

need to employ many.

Relative to most

countries including

Australia, India,

EU states etc,

there are state-

to-state 'tax

agreements'

with Norway.

This ensures

that no double tax

on salaries have

to be paid.

Relative to

these countries,

BERLiNiB registers

salaries as paid

to the employees

in the Norwegian

state forms

on the assumption

that employees

pay tax on income as

received from a

foreign company

(rather than paying

tax to the

Norwegian state)

insofar it is required.

The other type

of payments to our

freelancers are for

relevant expenses,

whether it be fashion

or art equipment or

technical equipment

for fashion photo,

or background fashion

scenes for journalism,

or clothes, travel,

hotel and such for

models. For expenses,

receipts/checks/bills

are given to BERLiNiB,

eg by the employee,

and the expenses are

paid and accounted for

at the the same Norwegian

state portal that

records salaries, on

the presumption that

no taxes are paid on

just these sums,

of course.

This state portal is:

https://altinn.no/en/

NEW FREELANCERS IN BERLiNiB

New freelancers

are registered

in the Norwegian

State's online

tax pages by us

in BERLiNiB. Some

of these pages,

esp. info pages,

are available

without login.

The central Norwegian

state website

for this accounting

is called 'AltInn'

(literally, "all in").

Norwegian Tax State page:

https://altinn.no/en/

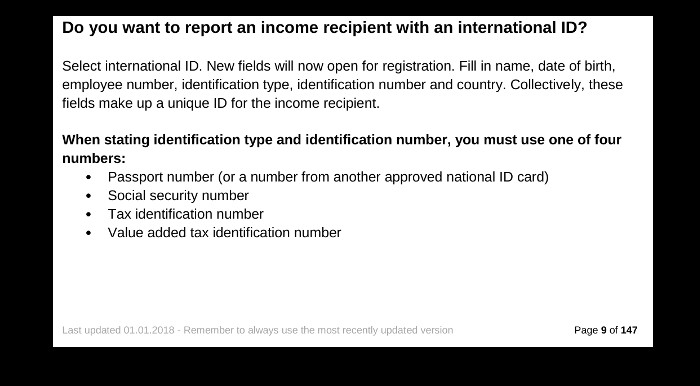

On page 9 to 10

in the following

2019 PDF AltInn

document, we can

read about what

info is required info

about an employee to

legally receive

international salary:

PDF Document from Norwegian State

Key information on page 9

is replicated here:

BERLiNiB Employee Info

This page,

berlinib.com/

berlinib_employee_info

has in it company information

and information as to

how BERLiNiB gives

freelance salary

to individuals

in other countries

than the country

of origin of BERLiNiB,

namely Norway

(speaking in formal terms).

The first part is

chiefly information

to tax officials

in these other

countries.

The second part is

information to

new freelance

employees as to

what information

is required from

them to be correctly

registered as

freelancers for BERLiNiB

with the

Norwegian State's online

tax forms:

in sum, it is birth date

and either passport

number or the code

on a government-issued

id card.

As soon as you

have given BERLiNiB

this information

(which we treat

confidentially,

of course), find out

about how you pay tax

nationally on 'salary

received from a small

foreign company for

freelance work', and

do this paperwork

in same season.

INFORMATION FOR

TAX OFFICIALS

IN COUNTRIES

WITH FREELANCERS

WORKING FOR BERLiNiB

Those who contribute

to the BERLiNiB

magazine in a way

that involve us paying

them a salary

are registered as

employees, initially

of a freelance type,

so that they

can legally receive

salary for the work

they do through

such as Wise or PayPal

to their bank account.

See full formal info

about this company

at the bottom of

this page.

In general BERLiNiB,

which only comes

three times pr year and

with a certain number

of pages, does not

need to employ many.

Relative to most

countries including

Australia, India,

EU states etc,

there are state-

to-state 'tax

agreements'

with Norway.

This ensures

that no double tax

on salaries have

to be paid.

Relative to

these countries,

BERLiNiB registers

salaries as paid

to the employees

in the Norwegian

state forms

on the assumption

that employees

pay tax on income as

received from a

foreign company

(rather than paying

tax to the

Norwegian state)

insofar it is required.

The other type

of payments to our

freelancers are for

relevant expenses,

whether it be fashion

or art equipment or

technical equipment

for fashion photo,

or background fashion

scenes for journalism,

or clothes, travel,

hotel and such for

models. For expenses,

receipts/checks/bills

are given to BERLiNiB,

eg by the employee,

and the expenses are

paid and accounted for

at the the same Norwegian

state portal that

records salaries, on

the presumption that

no taxes are paid on

just these sums,

of course.

This state portal is:

https://altinn.no/en/

NEW FREELANCERS IN BERLiNiB

New freelancers

are registered

in the Norwegian

State's online

tax pages by us

in BERLiNiB. Some

of these pages,

esp. info pages,

are available

without login.

The central Norwegian

state website

for this accounting

is called 'AltInn'

(literally, "all in").

Norwegian Tax State page:

https://altinn.no/en/

On page 9 to 10

in the following

2019 PDF AltInn

document, we can

read about what

info is required info

about an employee to

legally receive

international salary:

PDF Document from Norwegian State

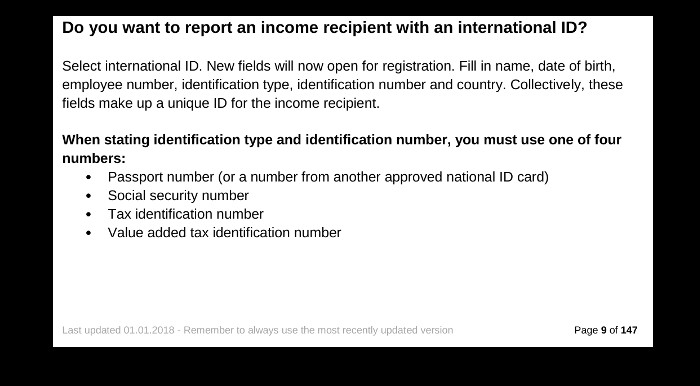

Key information on page 9

is replicated here:

In sum, what is required

for you as a new employee

in BERLiNiB is to send

the following information

to BERLiNiB:

* Name, as in passport

* Freely selected any one of

these four numbers:

1) Passport number

2) Social security number

3) Tax id number

4) Value added tax id number

* And date of birth.

An example of

2) and 3): the code

number that exists

on a government-

issued id card

used in connection

eg with paying

national taxes.

Note: If you often

work as a freelancer

for various

companies across

the world,

you may find,

at least in some

countries, that it

is an easier process

to have your

own company

and send an invoice

from it,

or to enlist yourself

as employee in a company

that does this type

of service

for its employees.

FORMAL INFO ABOUT BERLiNiB

BERLiNiB, as at berlinib dot com,

is a fashion magazine, which

is freely available for all

in PDF quality form.

The website

www.berlinib.com

refers to

www.industrialbabes.com.

The two letters

'ib' is an

abbreviation of

'IndustrialBabes'.

BERLiNiB: A QUALITY

ISSN-REGISTERED

DIGITAL FREE PUBLICATION

BERLiNiB,

with an orientation towards

fashion oriented people

including young adult

women.

The founding editor's

private company

publishes BERLiNiB.

This company is:

Yoga4d von Reusch Gamemakers,

organisation number

985230560,

formal mail address:

Sorumsgt 9,

2000 Lillestrom, Norway.

Founding editor:

Stein H. (Henning) Reusch,

artist name Aristo Tacoma.

Contact email:

berlinib @ aol . com.

Main editorial page

has additional info.

In sum, what is required

for you as a new employee

in BERLiNiB is to send

the following information

to BERLiNiB:

* Name, as in passport

* Freely selected any one of

these four numbers:

1) Passport number

2) Social security number

3) Tax id number

4) Value added tax id number

* And date of birth.

An example of

2) and 3): the code

number that exists

on a government-

issued id card

used in connection

eg with paying

national taxes.

Note: If you often

work as a freelancer

for various

companies across

the world,

you may find,

at least in some

countries, that it

is an easier process

to have your

own company

and send an invoice

from it,

or to enlist yourself

as employee in a company

that does this type

of service

for its employees.

FORMAL INFO ABOUT BERLiNiB

BERLiNiB, as at berlinib dot com,

is a fashion magazine, which

is freely available for all

in PDF quality form.

The website

www.berlinib.com

refers to

www.industrialbabes.com.

The two letters

'ib' is an

abbreviation of

'IndustrialBabes'.

BERLiNiB: A QUALITY

ISSN-REGISTERED

DIGITAL FREE PUBLICATION

BERLiNiB,

with an orientation towards

fashion oriented people

including young adult

women.

The founding editor's

private company

publishes BERLiNiB.

This company is:

Yoga4d von Reusch Gamemakers,

organisation number

985230560,

formal mail address:

Sorumsgt 9,

2000 Lillestrom, Norway.

Founding editor:

Stein H. (Henning) Reusch,

artist name Aristo Tacoma.

Contact email:

berlinib @ aol . com.

Main editorial page

has additional info.

BERLiNiB Employee Info

This page,

berlinib.com/

berlinib_employee_info

has in it company information

and information as to

how BERLiNiB gives

freelance salary

to individuals

in other countries

than the country

of origin of BERLiNiB,

namely Norway

(speaking in formal terms).

The first part is

chiefly information

to tax officials

in these other

countries.

The second part is

information to

new freelance

employees as to

what information

is required from

them to be correctly

registered as

freelancers for BERLiNiB

with the

Norwegian State's online

tax forms:

in sum, it is birth date

and either passport

number or the code

on a government-issued

id card.

As soon as you

have given BERLiNiB

this information

(which we treat

confidentially,

of course), find out

about how you pay tax

nationally on 'salary

received from a small

foreign company for

freelance work', and

do this paperwork

in same season.

INFORMATION FOR

TAX OFFICIALS

IN COUNTRIES

WITH FREELANCERS

WORKING FOR BERLiNiB

Those who contribute

to the BERLiNiB

magazine in a way

that involve us paying

them a salary

are registered as

employees, initially

of a freelance type,

so that they

can legally receive

salary for the work

they do through

such as Wise or PayPal

to their bank account.

See full formal info

about this company

at the bottom of

this page.

In general BERLiNiB,

which only comes

three times pr year and

with a certain number

of pages, does not

need to employ many.

Relative to most

countries including

Australia, India,

EU states etc,

there are state-

to-state 'tax

agreements'

with Norway.

This ensures

that no double tax

on salaries have

to be paid.

Relative to

these countries,

BERLiNiB registers

salaries as paid

to the employees

in the Norwegian

state forms

on the assumption

that employees

pay tax on income as

received from a

foreign company

(rather than paying

tax to the

Norwegian state)

insofar it is required.

The other type

of payments to our

freelancers are for

relevant expenses,

whether it be fashion

or art equipment or

technical equipment

for fashion photo,

or background fashion

scenes for journalism,

or clothes, travel,

hotel and such for

models. For expenses,

receipts/checks/bills

are given to BERLiNiB,

eg by the employee,

and the expenses are

paid and accounted for

at the the same Norwegian

state portal that

records salaries, on

the presumption that

no taxes are paid on

just these sums,

of course.

This state portal is:

https://altinn.no/en/

BERLiNiB Employee Info

This page,

berlinib.com/

berlinib_employee_info

has in it company information

and information as to

how BERLiNiB gives

freelance salary

to individuals

in other countries

than the country

of origin of BERLiNiB,

namely Norway

(speaking in formal terms).

The first part is

chiefly information

to tax officials

in these other

countries.

The second part is

information to

new freelance

employees as to

what information

is required from

them to be correctly

registered as

freelancers for BERLiNiB

with the

Norwegian State's online

tax forms:

in sum, it is birth date

and either passport

number or the code

on a government-issued

id card.

As soon as you

have given BERLiNiB

this information

(which we treat

confidentially,

of course), find out

about how you pay tax

nationally on 'salary

received from a small

foreign company for

freelance work', and

do this paperwork

in same season.

INFORMATION FOR

TAX OFFICIALS

IN COUNTRIES

WITH FREELANCERS

WORKING FOR BERLiNiB

Those who contribute

to the BERLiNiB

magazine in a way

that involve us paying

them a salary

are registered as

employees, initially

of a freelance type,

so that they

can legally receive

salary for the work

they do through

such as Wise or PayPal

to their bank account.

See full formal info

about this company

at the bottom of

this page.

In general BERLiNiB,

which only comes

three times pr year and

with a certain number

of pages, does not

need to employ many.

Relative to most

countries including

Australia, India,

EU states etc,

there are state-

to-state 'tax

agreements'

with Norway.

This ensures

that no double tax

on salaries have

to be paid.

Relative to

these countries,

BERLiNiB registers

salaries as paid

to the employees

in the Norwegian

state forms

on the assumption

that employees

pay tax on income as

received from a

foreign company

(rather than paying

tax to the

Norwegian state)

insofar it is required.

The other type

of payments to our

freelancers are for

relevant expenses,

whether it be fashion

or art equipment or

technical equipment

for fashion photo,

or background fashion

scenes for journalism,

or clothes, travel,

hotel and such for

models. For expenses,

receipts/checks/bills

are given to BERLiNiB,

eg by the employee,

and the expenses are

paid and accounted for

at the the same Norwegian

state portal that

records salaries, on

the presumption that

no taxes are paid on

just these sums,

of course.

This state portal is:

https://altinn.no/en/

In sum, what is required

for you as a new employee

in BERLiNiB is to send

the following information

to BERLiNiB:

* Name, as in passport

* Freely selected any one of

these four numbers:

1) Passport number

2) Social security number

3) Tax id number

4) Value added tax id number

* And date of birth.

An example of

2) and 3): the code

number that exists

on a government-

issued id card

used in connection

eg with paying

national taxes.

Note: If you often

work as a freelancer

for various

companies across

the world,

you may find,

at least in some

countries, that it

is an easier process

to have your

own company

and send an invoice

from it,

or to enlist yourself

as employee in a company

that does this type

of service

for its employees.

In sum, what is required

for you as a new employee

in BERLiNiB is to send

the following information

to BERLiNiB:

* Name, as in passport

* Freely selected any one of

these four numbers:

1) Passport number

2) Social security number

3) Tax id number

4) Value added tax id number

* And date of birth.

An example of

2) and 3): the code

number that exists

on a government-

issued id card

used in connection

eg with paying

national taxes.

Note: If you often

work as a freelancer

for various

companies across

the world,

you may find,

at least in some

countries, that it

is an easier process

to have your

own company

and send an invoice

from it,

or to enlist yourself

as employee in a company

that does this type

of service

for its employees.